What Happens To Cedar Fair Stock: Essential Insights

Cedar Fair stock performance reflects the company’s financial health, operational efficiency, and investor sentiment. Understanding key factors like revenue, debt, and market trends helps predict its future and make informed investment decisions.

Ever wondered what makes a company’s stock go up or down? It can seem a bit like a mystery, especially when it comes to businesses like Cedar Fair, the folks behind many of your favorite amusement parks. You might be curious about what influences Cedar Fair stock, whether you’re a thrill-seeker who loves their parks or just someone interested in how the stock market works. It’s a common question, and frankly, it can feel a little overwhelming at first. But don’t worry! We’re going to break down exactly what happens to Cedar Fair stock in plain, simple terms. You’ll learn about the key things that move its price, making it much easier to understand.

Understanding Cedar Fair: More Than Just Roller Coasters

Cedar Fair, L.P. (NYSE: FUN) is a leading name in the amusement park industry. They own and operate a collection of well-known parks across North America, including Cedar Point in Ohio, Knott’s Berry Farm in California, and Canada’s Wonderland near Toronto. These parks are the heart of their business, and their success directly impacts the company’s financial standing. Think about it – happy park-goers mean more ticket sales, more delicious food consumed, and more souvenirs bought! All of this contributes to Cedar Fair’s revenue.

The company operates as a limited partnership, which is a specific business structure that can have tax implications for investors. This structure is part of what makes Cedar Fair unique in the public market. Investors buy units of the partnership, and understanding this structure is the first step to understanding its stock performance.

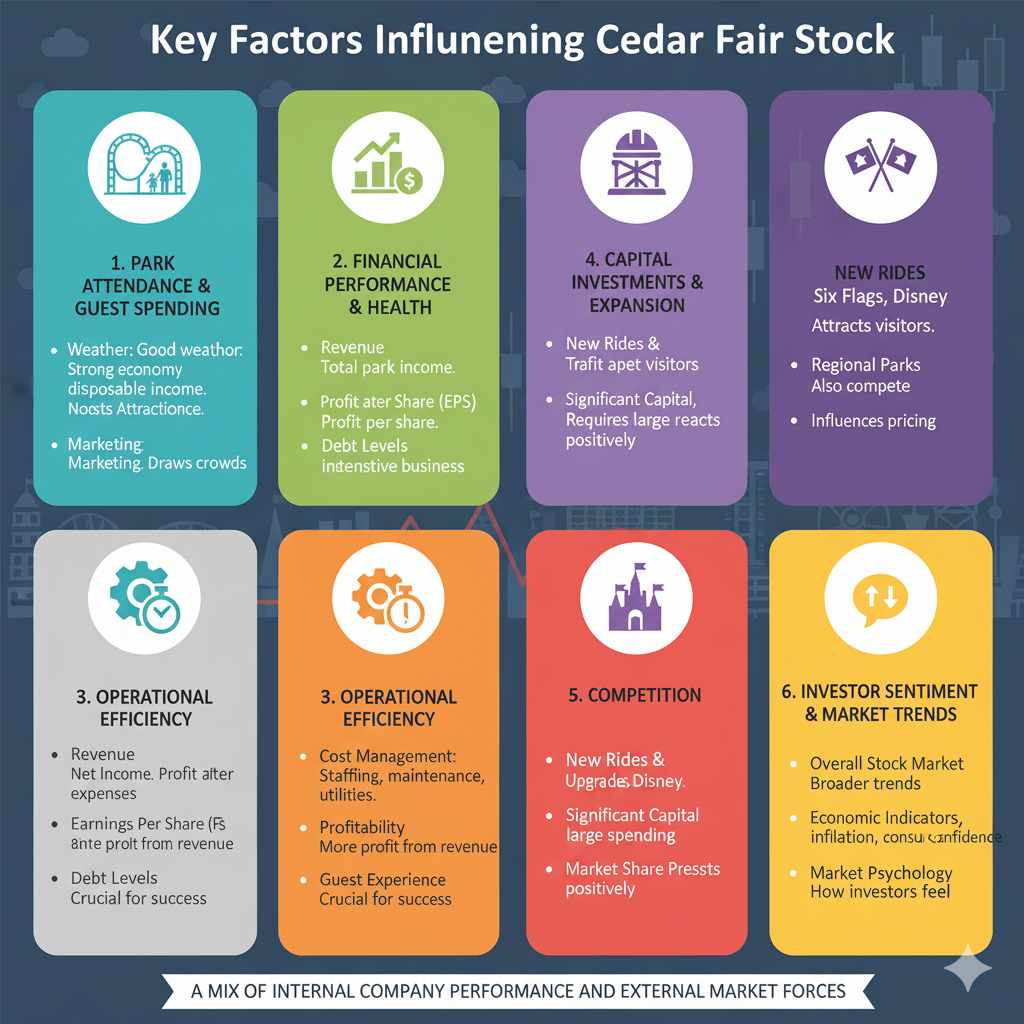

Key Factors Influencing Cedar Fair Stock

The price of Cedar Fair stock, like any publicly traded company, isn’t pulled out of thin air. It’s influenced by a mix of internal company performance and external market forces. Let’s explore the most important ones:

1. Park Attendance and Guest Spending

This is the most direct driver of Cedar Fair’s revenue. When more people visit their parks, and when those visitors spend more on tickets, food, merchandise, and games, the company makes more money. Factors that influence attendance include:

- Weather: Good weather generally means more visitors. Extreme heat, cold, or rain can deter people from visiting amusement parks.

- Economic Conditions: During strong economic times, people have more disposable income for leisure activities like visiting theme parks. In economic downturns, discretionary spending often decreases.

- New Attractions and Events: Cedar Fair invests in new rides, shows, and themed events to draw in crowds and encourage repeat visits. A blockbuster new roller coaster can significantly boost attendance.

- Marketing and Promotions: Effective advertising campaigns and special offers can draw more visitors to the parks.

2. Financial Performance and Health

Investors closely watch Cedar Fair’s financial reports. Key metrics include:

- Revenue: The total income generated from park operations.

- Net Income: The profit left after all expenses are paid.

- Earnings Per Share (EPS): A company’s profit allocated to each outstanding share of common stock. Higher EPS generally signals good performance.

- Debt Levels: Amusement park businesses can be capital-intensive, requiring significant investment in rides and infrastructure. High debt levels can be a concern for investors if the company struggles to manage it.

You can find Cedar Fair’s financial reports on their investor relations website or through financial news sources.

3. Operational Efficiency and Cost Management

Running amusement parks involves many operational costs, such as staffing, maintenance, utilities, and marketing. How well Cedar Fair manages these costs directly affects its profitability. Efficient operations mean they can generate more profit from the revenue they bring in. Keeping rides well-maintained and ensuring a positive guest experience are crucial for operational success.

4. Capital Investments and Expansion

Cedar Fair continuously reinvests in its parks. This includes building new thrilling rides, upgrading existing attractions, and enhancing guest amenities. While these investments are essential for long-term growth and attracting visitors, they also require significant capital. The market often reacts to news about major new projects, as these signal future growth potential but also immediate spending.

5. Competition

The amusement park industry is competitive. Cedar Fair competes with other major theme park operators like Six Flags and Walt Disney Parks and Resorts, as well as smaller regional parks. Strong competition can put pressure on pricing and attendance, influencing Cedar Fair’s market share and profitability.

6. Investor Sentiment and Market Trends

Beyond the company’s specific performance, broader market trends and investor sentiment play a role. If the overall stock market is performing poorly, even a well-run company like Cedar Fair might see its stock price decline. Conversely, a bullish market can lift most stocks, including Cedar Fair.

Factors like interest rates, inflation, and consumer confidence can also indirectly affect how investors feel about leisure and entertainment stocks.

How to Track Cedar Fair Stock

Keeping an eye on Cedar Fair’s stock is relatively straightforward. Here are some reliable ways to do it:

1. Financial News Websites

Major financial news outlets provide real-time stock quotes, charts, and news related to Cedar Fair. Some popular options include:

- Yahoo Finance: Offers detailed stock information, news, and analysis.

- Google Finance: Provides quick stock quotes and related news articles.

- Bloomberg: A comprehensive source for financial news and market data.

- The Wall Street Journal: Offers in-depth market coverage.

When you visit these sites, search for Cedar Fair’s ticker symbol, which is FUN. This will bring up specific data for their stock.

2. Stock Brokerage Accounts

If you have an investment account with a brokerage firm (like Fidelity, Charles Schwab, Robinhood, etc.), you can access real-time stock quotes and charts directly through their trading platforms. These platforms often provide research tools and analyst ratings as well.

3. Cedar Fair’s Investor Relations Website

Cedar Fair maintains a dedicated Investor Relations section on its corporate website. This is an excellent source for official company news, financial reports (like 10-K and 10-Q filings with the U.S. Securities and Exchange Commission, or SEC), investor presentations, and information about upcoming earnings calls. Accessing SEC filings directly via the SEC EDGAR database can provide the most direct look at their regulatory disclosures.

Analyzing Cedar Fair Stock Performance with Key Metrics

To really understand what’s happening with Cedar Fair stock, it helps to look at some specific financial metrics and how they’ve trended over time. While I can’t provide live stock data, I can explain what to look for.

Revenue Trends

Tracking Cedar Fair’s revenue over several quarters and years shows its growth trajectory. An increasing revenue trend generally suggests the company is successfully attracting more visitors and getting them to spend more. Conversely, declining revenue might indicate challenges with attendance, pricing, or the overall market.

Debt-to-Equity Ratio

This ratio shows how much debt a company is using to finance its assets compared to the value of shareholders’ equity. A high debt-to-equity ratio can signal higher risk, especially if revenue is inconsistent. Cedar Fair, like many companies in the entertainment sector, uses debt to fund large capital projects. Understanding their ability to service this debt is crucial.

To get current figures for the Debt-to-Equity ratio and other financial health indicators, you’d typically check their latest annual report (10-K) or quarterly report (10-Q) available on their investor relations site or through financial data providers. For instance, a company like Moody’s provides credit ratings that can offer an external view on a company’s financial stability and debt management.

Dividend Payouts

As a limited partnership, Cedar Fair often distributes a significant portion of its earnings to unitholders in the form of distributions (similar to dividends). The consistency and growth of these distributions can be a key indicator of the company’s financial health and its ability to generate consistent cash flow. A reliable or growing distribution history is often attractive to income-focused investors.

What Happens During Key Events?

Certain events tend to cause significant movements in Cedar Fair’s stock price. Here’s a look at some common ones:

Earnings Reports

Cedar Fair, like all public companies, releases its quarterly and annual earnings reports on a set schedule. These reports detail the company’s financial performance.

Key things investors look for:

- Revenue beat or miss: Did they earn more or less than analysts expected?

- Profitability: How much profit did they make compared to expectations?

- Guidance: What is the company’s outlook for future performance? Optimistic guidance can boost the stock, while pessimistic guidance can cause it to fall.

A positive earnings surprise can lead to an immediate stock price increase, while a miss can cause a sharp decline.

Acquisitions and Mergers

News about Cedar Fair acquiring another company or merging with a competitor can significantly impact its stock. These events can create opportunities for growth and synergy but also introduce risks and integration challenges. For example, the proposed merger with Six Flags was a major event that captured investor attention and influenced stock movements for both companies.

Major Capital Projects

Announcements of new, large-scale roller coasters or significant park expansions often generate excitement. While these represent future growth, the announcement itself and early reports on construction can lead to stock price fluctuations.

Economic Data Releases

Broader economic reports, such as unemployment rates, consumer confidence indexes, and inflation figures, can influence the market’s perception of discretionary spending on entertainment. Stronger economic indicators often lead to a more positive outlook for companies like Cedar Fair.

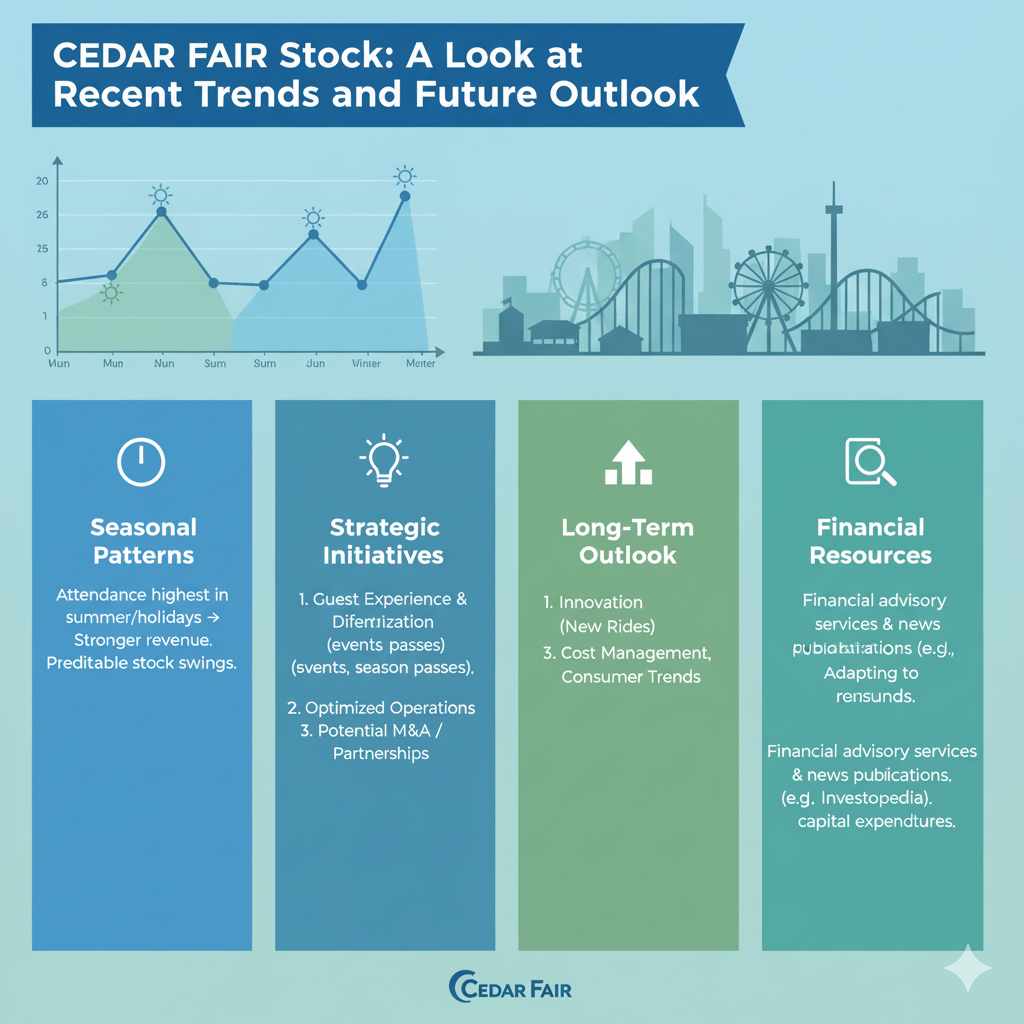

Cedar Fair Stock: A Look at Recent Trends and Future Outlook

Cedar Fair’s stock performance is often tied to seasonal patterns. Theme park attendance is typically highest during the summer months and holiday seasons, leading to stronger revenue in those periods. This seasonality can create predictable upswings and downswings in the stock price throughout the year.

In recent years, the company has focused on strategic initiatives to improve guest experience, diversify revenue streams (e.g., through in-park events and season passes), and optimize operations. The ongoing evaluation of potential strategic actions, such as mergers or partnerships, also remains a significant factor investors watch closely.

The long-term outlook for Cedar Fair stock depends on its ability to continue innovating, managing costs effectively, and adapting to changing consumer preferences and economic conditions. Investing in new rides, improving customer service, and expanding its reach are all critical components for sustained growth.

For those interested in the company’s structure and financial strategy, resources from financial advisory services and well-established financial news publications are invaluable. For example, understanding the impact of capital expenditures on a company’s balance sheet is a common topic in finance discussions on sites like Investopedia.

Frequently Asked Questions about Cedar Fair Stock

Q1: What is Cedar Fair’s stock ticker symbol?

A1: Cedar Fair’s stock ticker symbol is FUN, and it trades on the New York Stock Exchange (NYSE).

Q2: How does the weather affect Cedar Fair stock?

A2: Good weather generally boosts attendance and spending, leading to better financial results and potentially a higher stock price. Bad weather can have the opposite effect.

Q3: Should I consider Cedar Fair stock for my investment portfolio?

A3: Investing in any stock involves risk. Cedar Fair’s performance is tied to the entertainment and leisure industries, which can be sensitive to economic conditions. It’s wise to consult with a financial advisor to determine if it aligns with your personal investment goals and risk tolerance.

Q4: Where can I find Cedar Fair’s financial reports?

A4: You can find official financial reports, including annual (10-K) and quarterly (10-Q) filings, on Cedar Fair’s Investor Relations website. They are also often available on financial news platforms and through brokerage accounts.

Q5: What kind of returns can I expect from Cedar Fair stock?

A5: Stock returns are not guaranteed and can vary significantly. Cedar Fair’s performance depends on many factors, including operational success, economic conditions, and market sentiment. Past performance is not indicative of future results.

Q6: How does Cedar Fair’s structure as a Limited Partnership (LP) affect its stock?

A6: As an LP, Cedar Fair often makes regular cash distributions to its unitholders. This can be attractive to income investors. However, the partnership structure also has specific tax implications that are different from traditional corporate stocks.

Conclusion

Understanding what happens to Cedar Fair stock is about looking at the whole picture. It’s a blend of thrilling rides bringing guests through the gates, smart financial management behind the scenes, and how the company navigates the competitive entertainment landscape. By keeping an eye on park attendance, spending habits, financial reports, and even the broader economic climate, you can get a clearer sense of the forces that shape the value of Cedar Fair’s stock. Remember, investing is a journey, and with a little research and understanding, you can feel more confident about the businesses you choose to be a part of.